how to withdraw money from epf

The provision to withdraw money from EPF accounts was first announced in March 2020 under the Pradhan Mantri Garib Kalyan Yojana PMGKY According to the withdrawal rules EPFO members can take non-refundable withdrawals of up to three months basic earnings and dearness allowance or 75 percent of the EPF account balance whichever is smaller. - Employee need to check if he joined EPF after 01092014 and his BasicDA was above Rs15000 and his employer deducted his Pension fund which was actually not supposed to be deducted.

How To Withdraw Money From Epf Emplyee Provident Fund Login Account Withdraw Money From Your Epf Account And All The Details Related To Epf Money Withdrawal

Your Money Edited by NDTV Business Desk.

. Select Claim Form-19 31 10C 10D from the Online Services tab. Any employee who contributes to an EPF account can check the balance in hisher EPF account via online channels. However during the period when contributions dont get credited to the PF account the interest rate earned does not remain tax-free.

EPF subscribers need to log in to the official portal of the EPFO using their Universal Account Number UAN. While the EPF is a lifetime deposit there are provisions to withdraw money from the EPF early as well. EPFO has allowed members ie.

How to Withdraw EPF Online. How Much Can a Person Withdraw from EPS Account. There is generally a 2 month waiting period after resignation after which you can opt to withdraw your PF money.

The contributory employees to dip into their retirement savings to own a home of their own. What is the process for EPF withdrawal. A new webpage will open where you need to provide the correct bank.

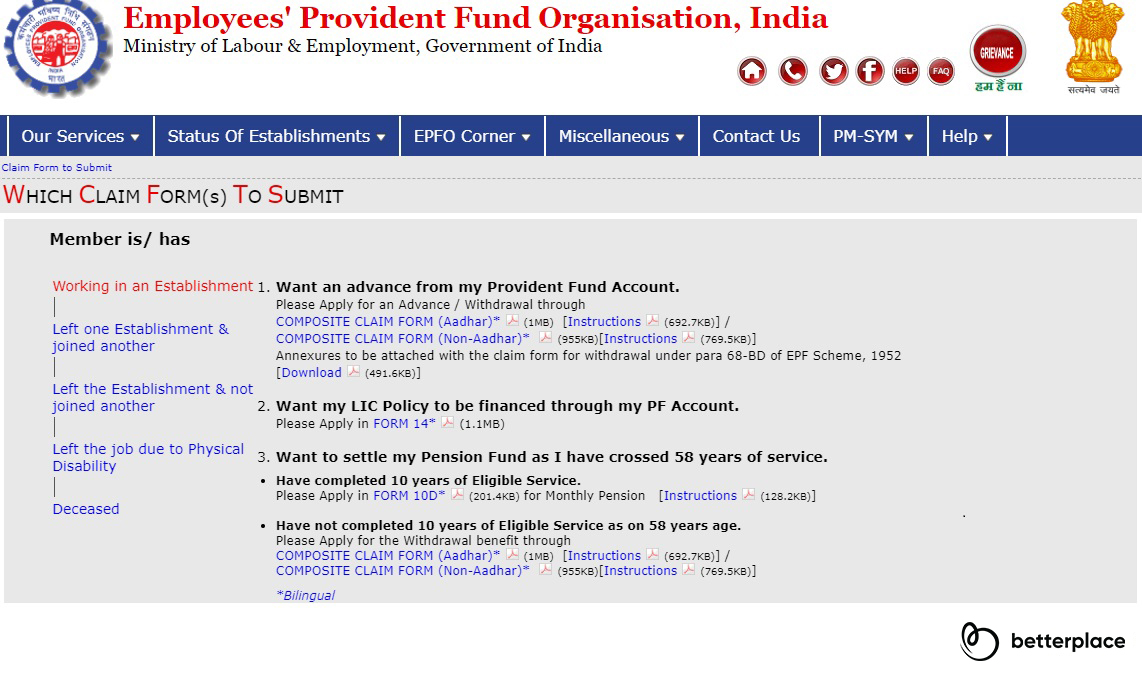

EPF withdrawal with a physical application. The first step would be to visit the EPFO website and fill the required EPF claim form. According to a Bengaluru bench of the Income-Tax Appellate Tribunal ITAT ruling the interest credited to an Employees Provident Fund EPF account after an individual ceases to be in employment is taxable in his hands in the year of.

According to the EPF Act in order to claim the final PF settlement you have to be 58 years of age and retire from your jobThe rules also allow you to withdraw money in case of unemployment for. Submit a physical application for EPF withdrawal. After 8 years the fsagovuk redirects will be switched off on 1 Oct 2021 as part of decommissioning.

Procedure to withdraw funds from an EPF account that has been unclaimed. They do not have to wait for the employer to share the Employees Provident Fund EPF statement at the end of the year to know the balanc You can check your EPF balance using any of these facilities. July 10 2022 138 pm IST.

KUALA LUMPUR Sept 20. Visit the Member e-Sewa portal on the EPFO portal. The procedure to withdraw funds from an unclaimed PF account is mentioned below.

Submit Form 15G for EPF Withdrawal online TDS Sample Filled Form 15G. The Employees Provident Fund or EPF may cause a slew of. To check your PF balance online click on the For Employees button.

When you dont get your EPF Withdrawal money though it shows Settled. In the case of not taking the next job in India you can withdraw the EPF account balance after immediately resignation. As per PFRDA Regulations 2015 subscriber can withdraw money as per following conditions.

How much time will it take for an EPF withdrawal claim to be settled. An EPF claim may take up to a maximum of 20 days to be settled. Bemoneyaware on December 17 2020 at 7.

Incorrect bank details etc. Upon Superannuation - When a subscriber reaches the age of 60 years of age he or she can withdraw up to 60 of the accumulated corpus as lumpsum and remaining share is invested for regular monthlyquarterly pension for period as chosen by the user. As per the EPF act 1952 any person who retires after completing service of 58 years minimum is eligible to withdraw the full PF amount and claim the EPS amount.

So what should I do to make my details approved without employer so I can withdraw my PF money. You cannot apply for withdrawal of EPF account balance immediately after your resignation from a company. To able to draw money from your EPF fund you can do one of the following.

So lets say your PPF account has Rs 25 lakh at the end of 15 years and you extend it with contributions for five more years. Further he will be eligible to get the Employees Pension Scheme amount as. How to check EPF passbook.

In a survey conducted by Sun Life Malaysia on retirement the life insurance and family takaful provider found that 4 of respondents admitted that their savings in the Employees Provident Fund EPF accounts no longer have enough amounts to withdrawIn a statement released on Tuesday Sept 20 Sun Life Malaysia said. While money has been credited to the bank. The actual EPF has warned that there were syndicates offering help to contributors withdraw their EPF savings early in return for a fee.

Withdrawal of the EPF amount from an unclaimed account is a very simple process. How to Withdraw Money from Unclaimed EPF Account. According to the Employees Provident Fund EPF Act to claim hisher final provident fund PF settlement one has to retire from service after attaining 58 years of age.

In March 2020 the Employees Provident Fund Organisation announced that members can withdraw money from their EPF corpus to tide over financial emergencies caused due to the coronavirus-induced lockdown. Follow the EPF withdrawal online procedure. Then you can withdraw a maximum of Rs 15 lakh ie 60 percent of.

If you see a social media post SMS or WhatsApp text claiming to be from the Employees Provident Fund EPF you should have your guard up. Contributions made towards the EPF scheme helps employees to withdraw a good amount of money in a lump sum at the time of their retirement. The initiative gets a shot in the arm by allowing members of EPFO ie.

These syndicates advertised their services on. Will I have to take the employers permission to withdraw the amount from EPF. Umang App EPFO Member e-Sewa portal.

The total EPF balance includes the employees contribution and that of the employer along with the accrued interest. Since then many people have submitted their requests to withdraw money from their EPF accounts. Following is mentioned the online process for EPF withdrawal.

The contributory employees of the provident fund PF scheme to use 90. The government it seems is pulling out all the stops in making Housing for All by 2022 a success. Sign in to your account with a password UAN and Captcha code.

No according to the latest amendments in the EPF norms you can withdraw the EPF amount without the employers permission. Employee and Employer contributions should be current in terms. The total PF amount is the total amount contributed by you- the employee and your employer plus the accrued interest.

All withdrawals made before the end of the five-year period are considered taxable income. For the withdrawal process to start successfully the following conditions must be satisfied. You can get the form from the EPF portal and print out and fill the physical application.

Conditions for EPF Corpus Withdrawal. However employees are allowed to make partial withdrawals during the course of their employment and the money can be used as a loan in case of financial emergencies. If an employee has an unclaimed PF balance he or she has the option of either withdrawing or transferring the funds to the present employer.

For EPFO portal balance check visit the EPF portal and click on Our Services on the dashboard.

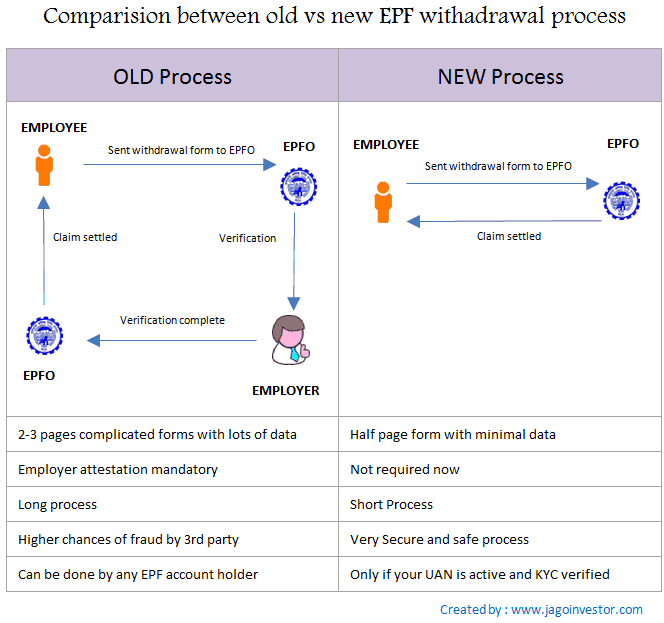

Epf Withdrawal Made Simple No Sign Required From Employer

Withdrawing Your Employees Provident Fund Corpus Is A Mistake You Must Avoid

Epf Claim Form Check Pf Withdrawal Form Online To Claim Epf

Covid 19 Related Early Withdrawals Top 32 Billion For Malaysia S Employees Provident Fund Pensions Investments

How To Withdraw 75 Of Your Epf Money If You Remain Unemployed For A Month Mint

Malaysia S Epf Ekes Out Small Gain Amid Early Withdrawals Pensions Investments

Pf Withdrawal How To Withdraw Pf Provident Fund Steps And Rules Explained

Epfo Withdrawal How To Avail Covid 19 Advance Twice From Pf Account

What Pf Withdrawal Rule Says For Medical Emergency Like Covid Mint

Epfo Epfo Settles 1 37 Lakh Epf Withdrawal Claims To Fight Covid 19 In Less Than 10 Days Press Release Https Pib Gov In Pressrelesedetailm Aspx Prid 1612849 Indiafightscorona Epfo Coronavirusoutbreak Socialsecurity Stayhomestaysafe Facebook

Epf Withdrawal Process How To Withdraw Pf Online Updated

Epf Form 31 Partial Pf Withdrawal Indiafilings

Pf Calculator Your Rs 6 27 Lakh Epf Balance Withdrawal Can Lead To Rs 18 12 Lakh Loss Post Retirement Zee Business

Epfo Employees Provident Fund Organisation Epfo Offers Online Facility To Withdraw Provident Fund Pf Money Check Here Facebook

Want Emergency Pf Withdrawal Avoid These 5 Mistakes Else You Will Lose Your Pf Money Zee Business

Epf Withdrawal Rules When Can You Partially Withdraw Your Pf Money Mint

Epfo Rules Partial Epf Withdrawal Last Date Is June 30 Correct These Mistakes Fast To Get Money In Account Zee Business

Pf Money Withdrawal Step By Step Guide To Do It Online Provident News India Tv

0 Response to "how to withdraw money from epf"

Post a Comment